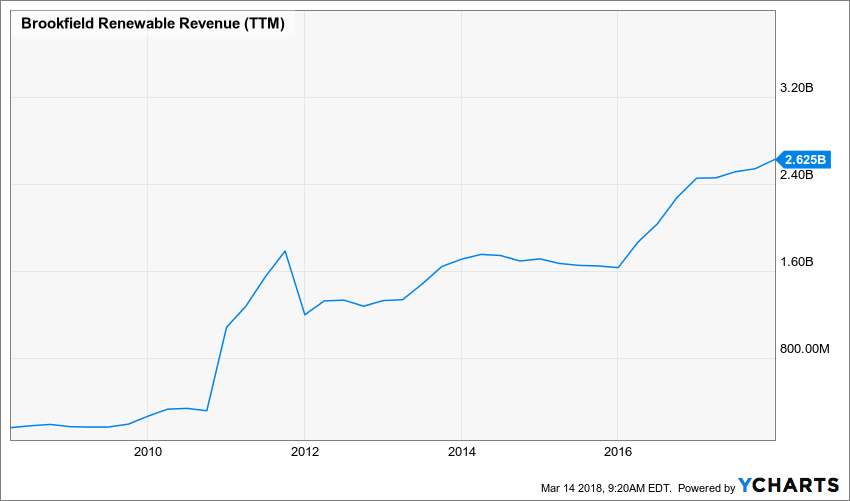

Climate change is a growing threat to sustainable development and the welfare of our planet. To help combat this, at over $300 billion in annual investment, clean energy is quickly becoming a high growth industry. As one of the largest pure-play renewable energy infrastructure companies, Brookfield Renewable Partners LP (TSX:BEP.UN) (NYSE:BEP) is poised to gain from the investment in this industry. The company operates under the Brookfield Asset Management (NYSE:BAM) umbrella.

BEP is Headquartered in Gatineau, Canada and based in Bermuda, BEP owns and operates hydro, wind, pumped storage, solar, and biomass electricity facilities in North America, Latin America, and Europe. BEP has expansion opportunities in other regions such as Southeast Asia.

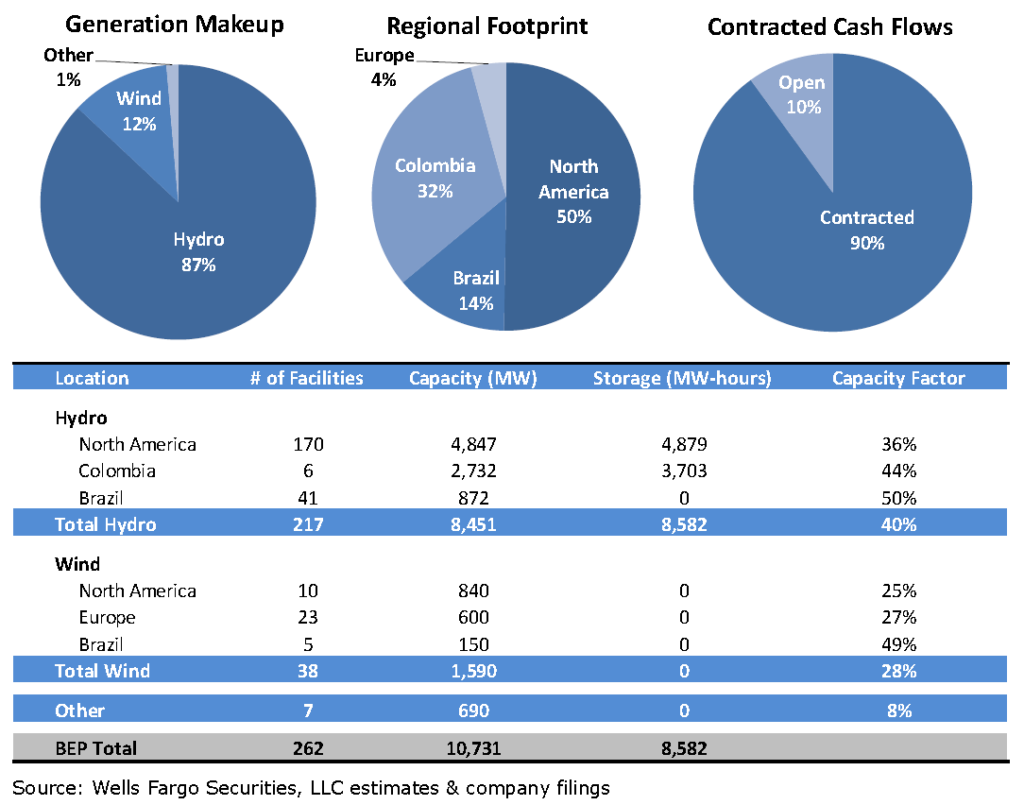

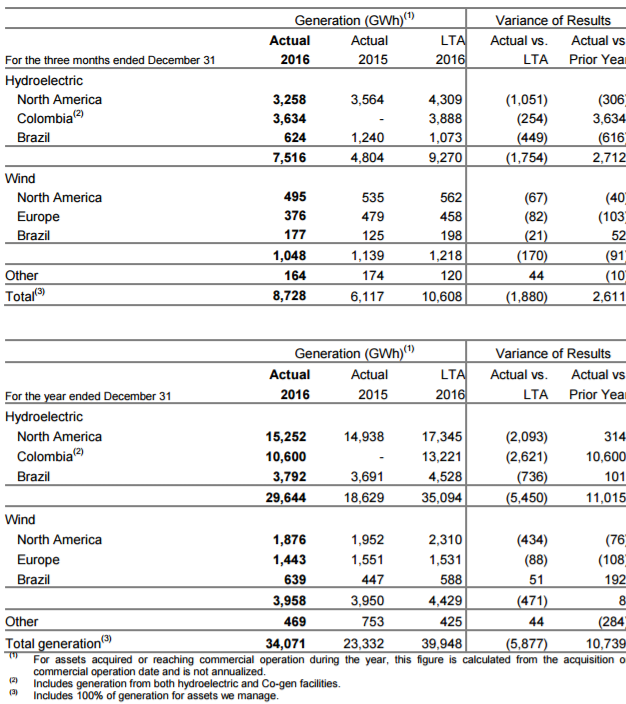

BEP’s strategy involves buying renewable assets at discounts when out of favor (Lawlor 2017). The company then re-vamps or builds new facilities, to create a best-in-class renewable energy portfolio that is actively managed, creating long-term value. 88% of the companies’ assets are hydro on 82 river systems and over 200 facilities (BEP 2017). 11% of BEP’s assets are in wind. In 2016, BEP generated 29,644 GWh and 3,958 GWh of Hydroelectric and Wind energy, respectively (BEP 2017).

Despite President Trump pulling out of the Paris Climate Accord, the threat of climate change will be a boon for BEP.

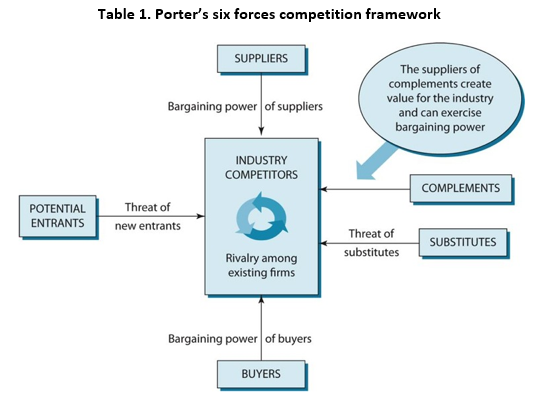

Porter’s Five Forces

Rivalry

The competitive landscape in the renewable energy industry differs drastically by country and region. The growth rate of industries can be a significant factor in competition, and the renewable energy industry is growing fast in turn driving price competition. However, as more companies look to both produce and buy green energy, competition is growing fierce. Product differentiation can be difficult to achieve with energy, which is a large contributor to competition. Its key competitors in North America are:

Northland Power

Northland Power, headquartered in Toronto, Canada owns and operates power generation in Canada and Europe. As of March 03, 2017, the company had a total capacity of approximately 1,394 megawatts.

Innergex Renewable Energy Inc.

Innergex Renewable Energy Inc., headquartered in Longueuil, Canada, operates independently in North America and France. As of February 21, 2017, it had in 47 operating facilities, at 939 MW, including 29 hydroelectric, 17 wind, 1 solar facility. Prospective projects totaled 3,560 MW.

NextEra Energy Partners, LP

Based in Juno Beach, Florida, NextEra Energy Partners, LP operates 2,926 MW wind and solar projects in North America, and seven contracted natural gas pipeline assets in Texas.

TransAlta Renewables Inc.

Calgary, Canada’s TransAlta Renewables Inc. 2,441 MW portfolio consists of 18 wind, 13 hydro, 8 gas facilities, and 1 natural gas pipeline In North America and Australia.

Bargaining Power of Suppliers

Renewable energy companies invest extensively in equipment used in providing their services. Investments make switching costs to new suppliers extremely high. Many processes are specific service-related to existing equipment, precluding switching from being an option at times.

Often specialized technology and components have large lead times making it difficult to change suppliers. This makes suppliers’ the bargaining power high for renewable energy companies.

Bargaining Power of Buyers

Consumers’ bargaining power is low in the renewable energy development market. Switching costs are low for customers in the position to shop energy providers. If a customer has entered a Power Purchase Agreement (PPA), a loan option, or lease option, these agreements can be for 20-30 years. A customer that has signed a 20-year contract agreement with renewable energy company is essentially handcuffed to their provider and respective rates unless they want to pay an enormous penalty or buy an entirely new system. For these customers, switching costs are extremely high. Often, PPAs or options are chosen by customers who are environmentally conscious, however unaware of all their energy purchase options.

In the future, buyers will slowly gain buying power as markets deregulate. However, even in deregulated markets, there is often a requirement to purchase green energy at a premium using mechanisms such as carbon taxes or carbon trading, giving BREP a high probability of supernormal profits.

The threat of New Entrants

To enter the sector, significant capital is required, meaning business takes time to start operating. Economies of scale also play a significant role, with businesses requiring differentiated technical knowledge, and R&D costs being extremely large. Brand identity is important in winning foreign markets. Government-regulated barriers to entry exist as well.

The threat of Substitute Products & Services

Fossil-fuel or nuclear power stations are substitutes, as is distributed generation and energy efficiency. Renewable energy is becoming affordable for consumers and can achieve grid parity soon, but has historically been more expensive. Economic benefits of substitutes make this the most severe threat level in the industry.

Another threat related to substitutes is nationalization of power. In unstable regions of the world, power production can become nationalized, with local governments seizing assets. This brings the risk of lost profits,

Complementary Products

Complementary products such as electric cars, grid energy storage, and energy load management are products and services becoming more mainstream as renewable energy penetration increases. These products and services will effectively increase the value proposition of renewable energy.

The future looks positive for BREP. It’s bargaining for instance, is the bargaining power of buyers likely to change in the future? Is the company attracting new buyers and could it preserve them was it not for regulation? These issues should have been discussed more given the nature of the industry – this is a regulated industry where strategy often can have a secondary role to institutions.

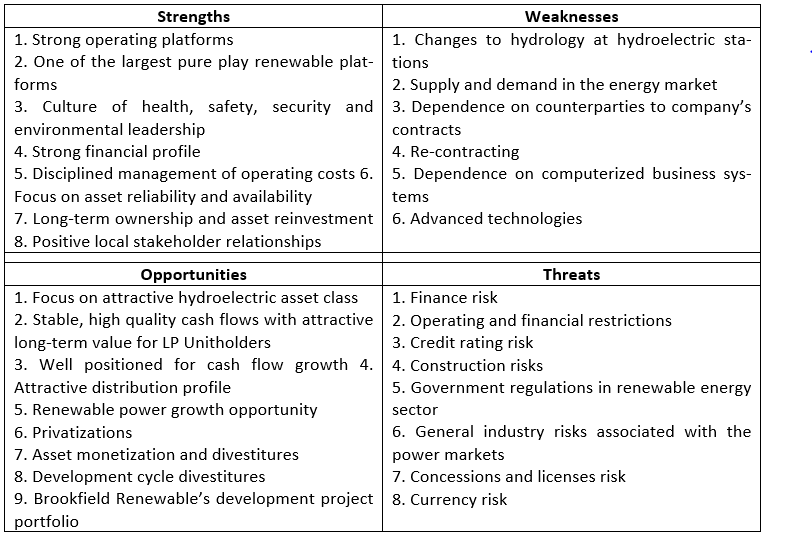

SWOT Analysis

Strengths

Brookfield has strong platforms with construction, development and operational capabilities, and one of the largest renewable energy portfolios. Centralized, automated plant dispatch and control allow remote operation of facilities and a central interface with regulatory and market authorities. Brookfield can leverage its platforms when growing its business.

Brookfield is recognized as an accident prevention industry leader. Health, Safety, Security and Environmental (“HSS&E”) policies include frameworks for oversight, compliance, compliance audits and sharing best practices both within its operations and at Brookfield globally. Brookfield requires all employees, contractors, and agents to comply with HSS&E practices. Transparent, relationships with stakeholders and communities affected by operations are fostered to ensure renewal and implementation of its water power licenses and land leases.

Brookfield’s has a strong financial position, with a debt ratio of 38% and 78% of borrowings being non-recourse. Borrowings have average terms of eight years. At December 31, 2016, liquidity was $1.2 in cash and equivalents. Stable, predictable cash flows from many hydroelectric and wind assets in long-term contracts with creditworthy parties are a strength. Most generation is contracted to public authorities, load-serving utilities, or industrial users. PPAs have an average remaining duration of 16 years providing long-term cash flow forecasts.

A competitive portfolio through disciplined operating cost management is a significant strength. Platform Scalability allows for growth while only incrementally increasing fixed costs, ensuring a predictable cost profile. Reliability and availability are essential; maintenance activities are made during low hydrology or wind periods to minimize lost revenue. A capital reinvestment plan with engineering firms and operations develop assets, resulting in low capital expenditure, low maintenance requirements, and long useful life.

Weaknesses

Revenues are correlated to power generation which depends on water flows, wind and weather conditions; climate change or natural disasters may these natural variations permanently. Profitability depends on current conditions at the site, and whether current conditions are consistent with assumptions during project development. Sustained declines in wind or water flows could permanently decrease electricity generated. Declines in sugarcane supply through drought, frost or floods, to sugar and ethanol mills could affect biomass cogeneration suppliers, limiting biomass electricity production.

Wholesale electricity prices are impacted by fuel prices (e.g. natural gas); generation management and excess generating capacity; emissions and pollution control costs including CO2; electricity market structure; and weather conditions. Electricity demand growth is influenced by macroeconomic conditions; energy prices; energy conservation; and demand-side management. Generating plant retirement timing, driven by environmental regulations, the scale, pace and structure of replacement capacity, make for a complex economic, environmental, and political interaction.

If PPA purchasers are unable/unwilling to fulfill contractual obligations or refuse power delivery, Brookfield could be affected, and may not be able to replace the agreement equivalent terms. Some PPAs will require future re-contracting. Similar prices and conditions may not be achievable. Brookfield’s indefinite term contracts at fixed MWh prices will not capture market price increases. Long-term PPAs with utilities, industrial or commercial end-users have obligations not guaranteed by Brookfield.

Brookfield relies on IT and telecommunication services to remotely control assets, interface with regulatory agencies, wholesale markets, and customers. Cybersecurity risks and IT security risks exist where breaches could go undetected for an extended period.

Finally, alternative technologies such as fuel cells, micro-turbines, and photovoltaic cells, with R&D to lower costs, or emissions improvements from fossil generation are a risk to Brookfield. Alternative generation methods could affect Brookfield’s competitive advantage.

Opportunities

Prospects of 6,000 MW in power development across operating platforms, the ability to capture operating efficiencies, strong acquisition capabilities, and rising power prices are growth opportunities. Brookfield has acquired or commissioned 80 hydro plants (approx. 5000 MW), 40 wind facilities (approx. 1500 MW) in the past decade. Operating and project development teams form a strategic relationship, accompanied by strong liquidity and capitalization.

Hydroelectricity is a long life, low cost and environmentally preferred. Brookfield’s water reservoirs can store 27% of annual generation, protecting against short-term water changes. Large-scale and quality assets form a competitive and scarce position to other renewable power generators. Predictable cash flows from hydroelectricity ensure sustainable yields. Renewable energy demand is growing through increasing cost-competitiveness with traditional technologies. Renewable energy investment in 2015 was $200 billion. Brookfield is well positioned to take advantage of this growth market.

Governments looking for private sector infrastructure funding could sell assets. Renewable capacity owned by industrial companies, independent power producers, or private equity investors sell renewable assets, as power may not be a core business, investment horizons are shorter, or markets are not strategic. Renewable power assets developed by smaller who seek to capture development-stage returns present Brookfield with opportunities to evaluate these assets acquire or partner with beneficial ones. Brookfield’s record, global scale, pension fund and institutional investor partnering allow it to participate in these opportunities.

Threats

Financing of future acquisitions and construction will happen through operations, capital recycling, debt, and equity sales. The debt will need to be replaced, and obtaining new debt or equity financing depends on markets (local and capital), operating performance, electricity prices, interest rates, credit risk assessments, and investor appetite for renewable energy investments. Capital may become limited or unavailable impairing acquisition plans, existing facilities’ operations.

Covenants on debt agreements, restrict indebtedness to a percentage of total capitalization, limiting additional financing. A covenant breach may require termination or expiry of credit, affecting credit rating, increasing interest, and financing costs. Ratings can affect financial position and ability to raise capital.

Facility construction depends on environmental, engineering and construction risks, affecting the cost, and schedule or future performance of projects. Permitting delays, engineering & design requirement changes, construction costs, contractor performance, labor disruptions and weather affect projects. Joint venture partners and communities may have or develop different or conflicting interests with Brookfield’s.

Renewable energy industry growth has recently been supported by provincial, national, and international policies. Renewable assets and economic returns are often enhanced by incentives. Regulations providing renewable energy incentives could change or expire, impacting the competitiveness of renewable energy. Brookfield is exposed to country-specific risks, such as a decline in the North American, Colombian, Brazilian or European economies in which it operates.

Internal Department Analysis

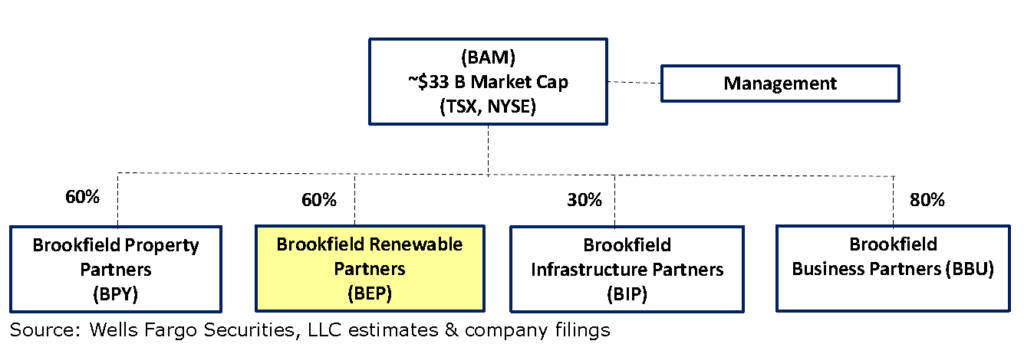

Brookfield is unique as an owner-operator where all operations are outsourced to a separate business unit under the Brookfield umbrella, Brookfield infrastructure partners. This allows BREP to focus on analytics-driven operating efficiency, while its integrated infrastructure unit operates hydro plants, wind plants, office buildings, mines, and other infrastructure. This analysis focuses on BREP.

Working under the Brookfield Asset Management umbrella, BREP’s organizational chart is shown above. From this chart, the departments that Brookfield has can be derived, and a departmental analysis created.

| Department | Activities drawing customers to BREP’s products & Services | Activities which lower costs |

| Finance | – PPAs with consistent power prices, allowing clients to forecast their future costs accurately | – Disciplined operating cost management. PPAs with creditworthy parties lower BREP’s borrowing costs. |

| Mergers & Acquisitions | – Leveraging platforms to lower fixed cost fraction of operations during acquisitions. | |

| Risk Management | – Reduce threats with environmental, engineering and construction risks of projects through strong platforms. – Reduce country-specific risks through diversification of acquisitions. – Reduce the effect of financial ratings through diversification & partnering with creditworthy parties. |

|

| Legal | – Leverage debt obligations through negotiating beneficial covenants on debt agreements. -Perform due diligence checks when acquiring new operations. |

|

| Technology | – Keep Brookfield coolness factor by using the latest technologies in operations – Develop a larger range of products and services to offer customers, more precisely fulfilling customer’s needs. |

– Minimize the risk of technological disruptions through self-disruption |

| Market research | – Determine which markets, customers, and technologies are the most compelling to invest in – Determine how market dynamics are changing both in existing and developing markets |

– Lower potential losses by staying ahead of the curve in terms of market dynamics |

| Solar Development | – Show environmentally conscious customers Brookfield is serious about the environment | – Minimize the risk of technological disruptions through self-disruption – Develop solar capacity as solar becomes viable through subsidies and cost reductions |

BREP uses each of its departments to either attract new customers or lower its costs. This gives BREP a key competitive advantage to other renewable energy owner-operators.

What Brownfield Can Do

Diversify outside North America and Brazil

Most of BREP’s assets are currently situated in North America and Brazil. In effect, if the Canadian & US Eastern seaboard is affected by lower rainfall, Brookfield’s net power generation, revenue, credit rating, and ability to operate can be affected. Expand to other high growth markets including countries with stable governments, open markets, and quickly growing populations, including but not limited to India, Colombia, Nigeria, and other high growth areas such as countries committed to the Paris accord.

Adapt to market decentralization trends in established markets

It is quite evident that future energy markets will become decentralized, which may leave Brookfield’s large hydro assets as stranded assets. Determine which distributed generation markets are the most compelling, and develop projects there to understand best practices, including run-of-river hydro; community wind, biomass and solar; as well as grid storage for distributed generation profiling.

Develop Co-generation Capabilities

Many industrial facilities can generate electricity using co-generation such as biomass or natural gas. This load shedding could adversely affect Brookfield, most notably in high margin markets. BREP should develop capabilities to disrupt these markets and move ahead of the curve with mechanisms such as energy services contracts.